How to Optimize Returns Via Real Estate Investment Opportunities

How to Optimize Returns Via Real Estate Investment Opportunities

Blog Article

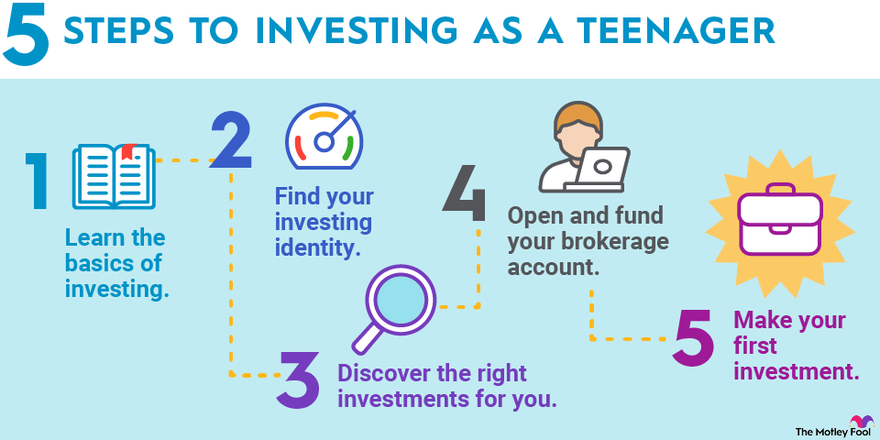

Newbie's Guide to Making Profitable Investments

Spending can commonly show up daunting for newbies, yet understanding its essential concepts is essential for browsing the complexities of monetary markets. Several beginners overlook essential strategies that can considerably influence their financial investment results.

Understanding Investment Essentials

Although spending can seem discouraging at first, understanding the fundamental ideas is important for any person wanting to develop wealth in time. At its core, investing involves the allocation of sources, generally capital, with the expectation of creating an income or profit. The key objective is to make educated choices that take full advantage of returns while taking care of risk.

A crucial principle in investing is the partnership in between risk and return. Generally, higher possible returns are related to higher levels of danger. Financiers must evaluate their risk tolerance, which is influenced by variables such as economic objectives, financial investment perspective, and individual circumstances.

Another essential concept is the value of diversity. Spreading out financial investments across different possession courses can alleviate danger, as the efficiency of various possessions typically differs. This method assists secure versus significant losses, guaranteeing that a recession in one area does not drastically affect the overall profile.

Furthermore, understanding market cycles and economic indicators can assist in making enlightened investment decisions. Financiers ought to remain notified about factors that affect markets, such as rates of interest and rising cost of living, which can affect the value of financial investments over time. By understanding these basics, people can browse the investment landscape with greater self-confidence.

Kinds of Investments

Investing incorporates a varied selection of alternatives, each with possible returns and unique qualities. Understanding these kinds can aid capitalists make notified choices based on their monetary goals.

Real estate is an additional financial investment method that permits people to acquire residential or commercial property for rental earnings or recognition. This concrete property can supply both cash money circulation and long-lasting worth development. Shared funds and exchange-traded funds (ETFs) use a varied profile of bonds and/or supplies handled by experts, making them ideal for those looking to minimize individual supply risk.

Products, such as gold, oil, and agricultural products, are physical items that can act as a bush versus inflation. Finally, cryptocurrencies have become digital properties that can supply high volatility and possibility for significant returns, albeit with substantial threat. Each investment kind brings special functions, making it important for financiers to straighten their choices with their economic goals.

Danger and Return

Understanding the various kinds of financial investments is just part of the formula; evaluating danger and return is just as important in making audio investment decisions. Every financial investment carries a particular level of threat, which refers to the opportunity of losing some or every one of your initial financial investment. Different possession courses, such as stocks, bonds, and realty, existing varying degrees of danger. Generally, greater potential returns are connected with greater threat degrees.

Return, on the other hand, is the gain or loss made from an investment, expressed as a portion of the initial financial investment. When considering an investment., it is crucial to examine both historic efficiency and potential future returns.

Capitalists must stabilize their risk tolerance with their return expectations. A conservative financier might favor low-risk financial investments with small returns, while a hostile financier might look for higher-risk possibilities that might produce substantial returns.

Recognizing the partnership in between threat and return helps financiers make informed decisions that align with their monetary goals and risk cravings. This assessment is important for navigating the investment landscape properly and making certain long-term economic success.

Structure Your Profile

Building a well-structured investment portfolio is essential for attaining long-lasting economic objectives. A diversified profile alleviates risk while enhancing potential returns, permitting financiers to weather market volatility. To begin, evaluate your financial purposes, time horizon, and threat tolerance. Understanding these variables will certainly guide your asset allocation approach, figuring out the proportions of supplies, bonds, and other investments in your profile.

Next, take into consideration branching out within property classes. Rather than spending solely in large-cap stocks, consist of small-cap, worldwide, and sector-specific equities. Within fixed-income safeties, discover government bonds, company bonds, and municipal bonds Resources to enhance stability.

Rebalancing your profile regularly is critical. Market fluctuations can skew your original property appropriation, leading to unintentional danger direct exposure. Frequently examine your financial investments to ensure positioning with your financial goals and make adjustments as needed.

Additionally, think about the influence of costs and tax obligations on your financial investment returns (Investment). Opt for low-cost investment cars and tax-efficient techniques to maximize growth

Tips for Successful Spending

Effective investing needs a critical strategy that incorporates technique, understanding, and a clear understanding of market dynamics. To begin, establish a well-defined financial investment strategy straightened with your economic goals and take the chance of tolerance. Research numerous possession courses, such as supplies, bonds, and realty, to expand your profile and reduce dangers.

Next, stay educated about market patterns and go to this web-site economic indications. Regularly assess your investments and remain versatile to altering conditions. This will certainly aid you make educated decisions and maximize possibilities as they develop.

In addition, avoid psychological decision-making. Stick to your technique and resist the impulse redirected here to react impulsively to market fluctuations. Carrying out a regimented approach will certainly help you stay concentrated on lasting purposes.

Think about the significance of continuous education and learning (Investment). Attend workshops, reviewed publications, and adhere to credible financial news resources to improve your understanding of investing concepts. Border yourself with experienced coaches or experts who can supply valuable insights and advice

Conclusion

Establishing clear financial goals and assessing danger tolerance are crucial actions in establishing an efficient property allowance approach. Recognition of different financial investment kinds and market trends contributes to educated decision-making.

Financiers must examine their risk tolerance, which is affected by elements such as economic goals, investment horizon, and individual circumstances.

Spreading out investments throughout different property classes can minimize risk, as the performance of various assets often varies.Comprehending the numerous kinds of investments is just part of the equation; analyzing risk and return is just as essential in making audio investment choices. Every financial investment lugs a certain level of danger, which refers to the possibility of losing some or all of your first investment. To begin, develop a distinct financial investment strategy lined up with your monetary goals and risk tolerance.

Report this page